Money isn’t just about earning anymore; it’s about what you do once you have it. The world keeps shifting, costs keep climbing, and the old advice — “save and you’ll be fine” — feels almost quaint now. Investing isn’t reserved for financial wizards in suits or people glued to stock tickers. It’s for anyone who wants their money to grow instead of sit quietly in a bank account losing value to inflation. Starting in 2025 means you’ve got access to more tools, education, and opportunity than ever before — you just need clarity, patience, and a willingness to learn.

Before diving into numbers and jargon, it helps to reset expectations. Investing isn’t about getting rich fast; it’s about getting rich slowly and consistently. The stories you hear about someone doubling their money overnight are outliers, not blueprints. The people who actually win at this game are the ones who build habits — not the ones who chase trends. If you treat investing like a sprint, you’ll burn out. Treat it like a long walk, and you’ll reach places most people never do.

Every beginner starts with confusion, so here’s the first truth: you don’t need a lot of money to begin. Most modern investment platforms allow you to start with as little as $10 or $20. The key is to start — not to wait until you “have enough.” The second truth: there’s no single correct way to invest. What works for your friend might not fit you at all. Your risk tolerance, goals, and time horizon shape your strategy more than any market prediction.

Let’s start with the basics. Investing means putting your money into assets — things that can grow in value or produce income. These include stocks, bonds, mutual funds, real estate, and index funds. Stocks are pieces of companies. When the company grows and profits, your share’s value can rise. Bonds are like loans to governments or corporations that pay you back with interest. Mutual funds and exchange-traded funds (ETFs) are baskets of many investments managed together, offering built-in diversification — basically, a way to spread risk so one bad apple doesn’t ruin your portfolio.

In 2025, technology has made access almost frictionless. There are apps that let you buy fractional shares, automatic investing tools that rebalance your portfolio for you, and educational resources that teach you the basics as you go. Robo-advisors like Betterment or Wealth front (or their newer clones) use algorithms to match your investments to your goals. If you’re unsure where to start, these platforms can be a good gateway. They take the emotion out of investing — which, ironically, is what humans struggle with most.

The real art is understanding why you’re investing. Write down your goals: are you saving for a house, retirement, or financial independence? The answer determines your strategy. A short-term goal (buying a car next year) doesn’t belong in risky assets like stocks. A long-term goal (retirement 30 years away) can handle market swings because you have time for recovery. Your money timeline defines your risk comfort.

Another pillar of successful investing is consistency. Setting up automatic contributions — even small ones — turns investing into a routine rather than an event. Think of it as a financial gym membership. You won’t see results overnight, but the compound growth over time can be astonishing. Compounding is the quiet magic that turns patience into profit. You earn returns on your returns, and the snowball effect takes over. Miss out early, and you lose the most valuable resource of all: time.

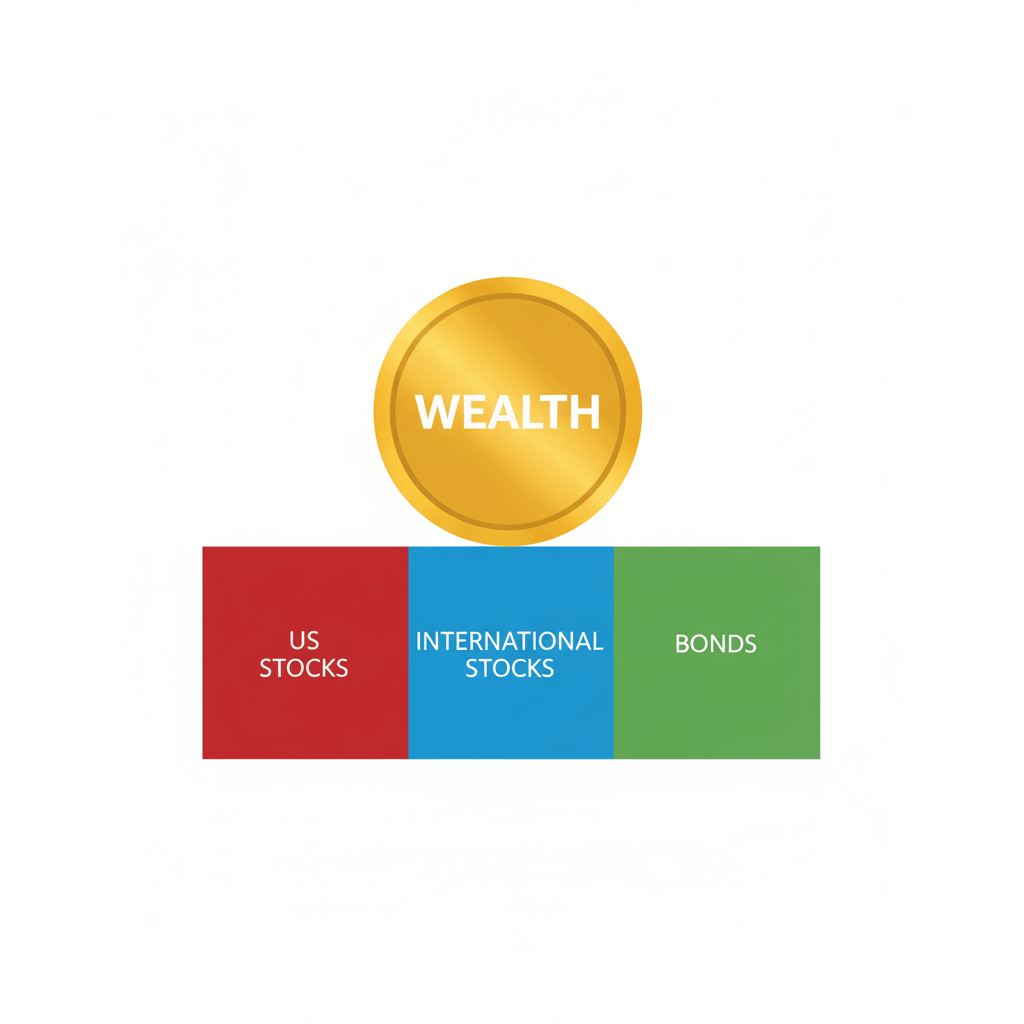

Diversification might sound boring, but it’s the backbone of a stable portfolio. Don’t put all your money in one stock because a YouTuber called it “the next big thing.” Spread it across sectors, industries, and even countries. This way, when one investment underperforms, others can cushion the fall. A good rule for beginners is the “three-fund” approach — one U.S. stock index fund, one international stock fund, and one bond fund. It’s simple, low-cost, and surprisingly effective.

Let’s talk about fear, because it’s the biggest barrier between people and investing. Markets rise and fall. Some days you’ll feel like a genius; others you’ll question every decision. The mistake most beginners make is reacting emotionally — selling when markets drop and buying when they soar. That’s the opposite of how wealth is built. The trick is to stay calm when everyone else panics. Long-term investors don’t time the market; they spend time in the market.

There’s also the social side of money to consider. In 2025, online noise about finance has never been louder. Every influencer claims to have the secret to wealth, and every algorithm feeds you advice tailored to your fears. Learn to filter it out. Real investing is quiet and often dull. It’s not about chasing hype or meme stocks — it’s about building habits and staying consistent. If a strategy sounds too exciting, it’s probably too risky.

As you grow more confident, you can explore more advanced ideas: dividend investing, real estate crowdfunding, or even green investing — where your money supports sustainable companies. But don’t rush it. Mastering the basics gives you the foundation to understand risks before you take them. The smartest investors aren’t the ones who make the most money; they’re the ones who lose the least when things go wrong.

And yes, mistakes will happen. You’ll pick a bad stock, misread a market signal, or panic-sell during a dip. It’s part of the process. The important thing is to learn and adjust, not to quit. Even seasoned investors get it wrong often; they just have systems that protect them from themselves. That’s why diversification, automation, and patience matter more than trying to predict the future.

If you’re wondering when to start, the answer is now. The best time to plant a tree was twenty years ago; the second-best time is today. Investing is no different. The earlier you begin, the longer your money has to work for you. Don’t let the fear of doing it wrong stop you from doing it at all. The biggest risk is not taking any.

Over time, your perspective changes. You stop obsessing over short-term gains and start valuing long-term growth. You realize that money, when handled with discipline, becomes more than numbers — it becomes freedom. Freedom to work less, travel more, help others, and live on your own terms.

So, start where you are, with what you have. Open a beginner-friendly investing app, set an automatic deposit, and let your money start earning while you sleep. Learn, adapt, and keep your expectations realistic. The road to financial security isn’t paved with luck or secrets — it’s built from patience, consistency, and courage.

And when you look back a few years from now, you’ll thank yourself for taking the first step — not because you got rich quick, but because you finally made your money start working as hard as you do.