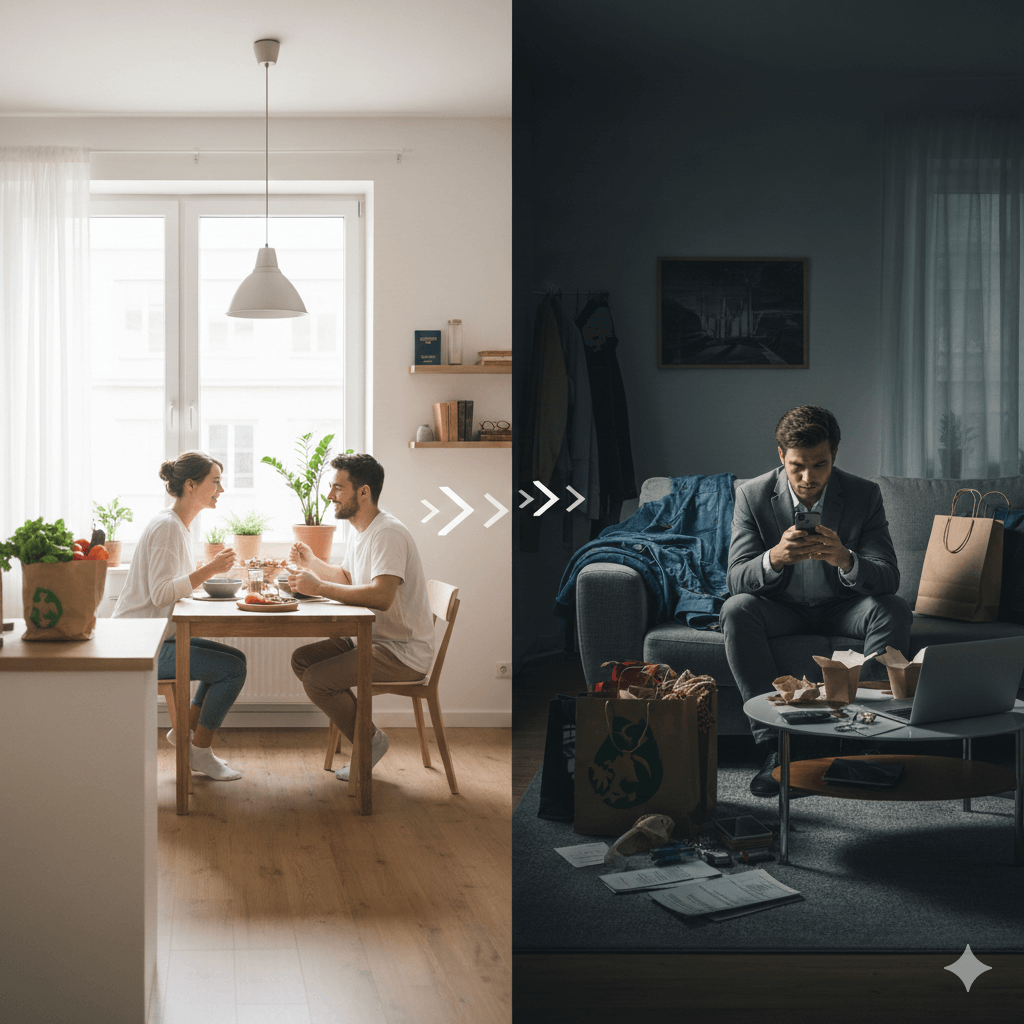

Many people assume that financial success is about earning more money. While income matters, it’s actually the choices you make with your money that have the greatest impact on your lifestyle and long-term well-being.

Understanding the Power of Money Decisions

Every day, we make countless decisions about money—what to spend, save, invest, or avoid. Individually, each decision may feel small, but over time, they compound. Financial habits, both good and bad, determine the quality of your lifestyle far more than a single paycheck.

For example, two people earning the same salary may have vastly different lives. One may feel stressed and constrained, while the other enjoys freedom and peace of mind. The difference isn’t income—it’s how money is managed.

Spending With Awareness

The first step in using money wisely is awareness. Many people spend out of habit or impulse rather than intentionality.

Try asking yourself:

- Do I really need this purchase, or am I buying it out of convenience or emotion?

- Will this spending align with my long-term goals?

- Could I achieve similar satisfaction at a lower cost?

By making spending intentional, you retain control over your finances and avoid accumulating unnecessary stress.

Prioritizing Savings

Saving isn’t just about money—it’s about freedom and options. Having a financial cushion reduces anxiety and allows you to make decisions based on opportunity rather than necessity.

Simple strategies include:

- Pay yourself first: Allocate a portion of your income to savings before spending elsewhere.

- Automate savings: Set up recurring transfers to a savings or investment account.

- Emergency fund: Maintain 3–6 months of expenses to cover unexpected events.

Even small amounts saved consistently can accumulate into significant financial security over time.

Smart Debt Management

Debt is a powerful tool but also a potential trap. High-interest debt can limit freedom and increase stress. Managing debt effectively is key to shaping a positive financial lifestyle.

Consider:

- Prioritizing high-interest debts first

- Avoiding unnecessary borrowing

- Using debt strategically for investments that appreciate, like education or property

Effective debt management reduces financial strain and allows you to focus on building wealth rather than just covering obligations.

Investing for the Future

Income alone rarely guarantees long-term security. Investing allows your money to grow and work for you. Start small if needed—consistency matters more than size.

Options include:

- Stock market or index funds

- Retirement accounts

- Low-risk bonds or mutual funds

The earlier you start, the more time your money has to grow. Even modest, consistent investments can dramatically impact your lifestyle over decades.

Mindset Over Money

Your mindset plays a crucial role in financial decisions. Avoid comparing yourself to others, and focus on aligning spending, saving, and investing with your personal values and goals.

Adopt a long-term perspective:

- Short-term sacrifices today can create freedom tomorrow.

- Avoid lifestyle inflation—higher income doesn’t have to mean proportionally higher spending.

A thoughtful mindset ensures your money decisions enhance your life rather than control it.

Conclusion

Your income may set the stage, but your financial choices shape the performance. Spending intentionally, saving consistently, managing debt wisely, and investing thoughtfully all influence your quality of life more than any paycheck.

By taking control of your money decisions today, you create a lifestyle that prioritizes freedom, peace of mind, and long-term fulfillment. Success isn’t just what you earn—it’s what you do with it.