Freedom is a word people chase all their lives, yet few define it clearly. The FIRE movement — Financial Independence, Retire Early — tried to do just that. What began as an online community of frugal dreamers has become a modern philosophy: spend less, save aggressively, invest wisely, and reclaim your time while you’re still young enough to enjoy it.

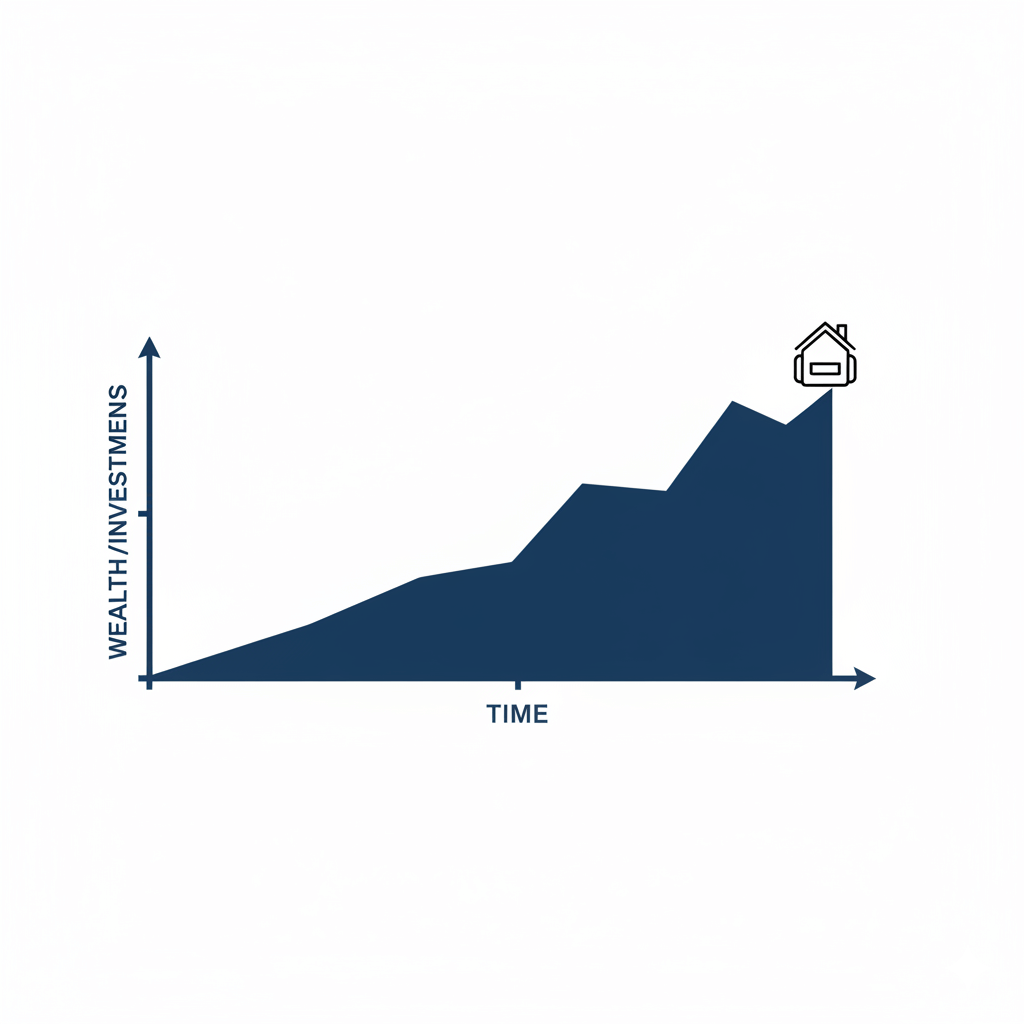

The math behind FIRE is deceptively simple. The idea is to save and invest enough so that the returns from your portfolio cover your living expenses indefinitely. Many followers aim for 25 times their annual spending — the so-called “FIRE number.” Once you hit it, work becomes optional. But the real story of FIRE isn’t numbers; it’s mindset.

At its core, FIRE challenges the assumption that we must trade decades of life for security. It asks uncomfortable questions: Do we really need all the things we buy? Are we working for freedom or for habits we never questioned? The movement’s heroes aren’t millionaires — they’re people who learned to live intentionally, aligning money with values rather than consumption.

There’s a quiet rebellion in living this way. Instead of chasing promotions or bigger houses, FIRE enthusiasts chase autonomy. They prioritize flexibility, time with family, creative projects, or travel over luxury cars and brand names. It’s not austerity for its own sake — it’s the realization that freedom feels better than things.

Of course, FIRE isn’t one-size-fits-all. The internet’s most viral examples — 30-year-olds retiring with millions — make it sound easy. Reality is messier. Inflation, family obligations, healthcare costs — they all complicate the dream. But the principles behind FIRE still hold power for everyone: spend less than you earn, invest the difference, and avoid debt traps.

The movement has branched into variations: Lean FIRE (living on minimal expenses), Fat FIRE (a higher-spending version), and Coast FIRE (saving enough early so compound growth does the rest). Whatever the label, the goal remains the same — designing a life where time belongs to you.

Critics argue that FIRE depends on privilege or unrealistic discipline. There’s truth there, but the heart of FIRE isn’t quitting work; it’s reclaiming control. Even if you never retire early, adopting its principles creates stability and peace of mind. Financial independence isn’t about escape — it’s about choice.

Living with FIRE values changes how you see money. Purchases start being measured in hours of your life, not dollars. A $200 gadget isn’t “affordable” if it costs you a week’s labor. That perspective rewires your priorities fast. Suddenly, investing in experiences, skills, or rest makes more sense than chasing upgrades.

The emotional shift is just as important as the financial one. People pursuing FIRE often discover they need less than they thought. Simplicity turns into satisfaction. When you stop buying things to prove something, you start finding joy in freedom itself — in slow mornings, quiet walks, and the ability to say no.

FIRE isn’t about rejecting work entirely; it’s about redefining it. Many who “retire early” still work — they just work differently. They teach, write, build small businesses, or volunteer. The difference is choice: they work because they want to, not because they must.

In the end, FIRE is less a movement than a mirror. It forces you to look at how you spend your time, money, and attention. Maybe you’ll chase it fully, or maybe you’ll just take pieces that fit your reality. Either way, it offers a valuable reminder — freedom doesn’t begin when you stop working. It begins when you start living intentionally.